Self-expression: Authentic, inclusive and experiential beauty

The self-expression trend in beauty and personal care is all about celebrating individuality, encouraging creativity, and fostering a sense of empowerment and confidence through products and routines. Brands that align with these values are likely to resonate with today's consumers who prioritise a new kind of beauty, one that is more authentic, inclusive and experiential.

- Authentic - Consumers are increasingly committed to being true to themselves and embracing who they are. They will prioritise searching for beauty products and brands that genuinely contribute to reflecting their identities and stay true to their views and values.

- Inclusive – Brands and product offerings should help consumers to feel welcome, served and seen. There is no one size fits all approach and consumers demand products and services that are adapted to personal attributes and needs.

- Experiential – Consumers seek new experiences and search for joy in the personal care space. Products should encourage them to express and experiment across beauty categories and applications.

In this blog, we will explore the key trend drivers outlined above in more detail, share the ways brands and the products they offer can meet the trend and provide formulation and ingredient inspiration from our portfolio.

Authentic – The end of beauty standards and changing perceptions of beauty

Beauty standards are the set of cultural norms that dictate what is considered aesthetically pleasing. Consumers are however increasingly realising that they reflect something unreachable and in recent years there has been a growing movement to challenge them. In fact, 63% of Gen Z believe that their generation is pushing back on outdated beauty standards.1

Many personal care brands and industry influencers are also supporting them, using their platforms to raise awareness of the potential damage caused by these expectations and promote more authentic and body-positive messaging. Examples include:

- Dove’s Cost of Beauty A promotional film exploring the real-life consequences of harmful beauty content through first-hand stories of young people.2

- Cult Beauty’s Can’t Re-Touch The brand committed to removing edited imagery from its website which helps to instil purchase confidence and promote authenticity.3

Campaigns like this help to change attitudes and empower consumers to be true to themselves. They are being encouraged to celebrate their ‘flaws’, embrace characteristics they might once have tried to change, and take the pressure to be ‘perfect’ off. It is less about what they can and should be and instead is a celebration of who they already are, helping to change the perception of beauty.

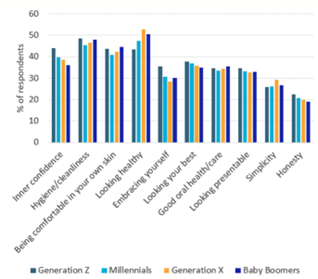

The graph below reflects this change across different consumer groups. The main perceptions of beauty amongst more than a third of consumers surveyed are good inner confidence, being clean, comfortable in their own skin and looking healthy.

Beauty Perceptions: Definition of Beauty4

This research highlights that emotional wellness and health have become more important than extrinsic motivations, such as being glamourous or meeting society’s expectations. Consumers however do still value looking their best and looking presentable, and therefore search for holistic solutions that combine looking and feeling good.

Inclusive – Feeling welcome, served and seen

Inclusivity in the personal care industry is not just about expanding the product range, but about fostering an environment of respect, acceptance, and empowerment. There is an expectation that everyone should feel welcome, served and seen. However, more than half of people (56%) think that the beauty and personal care industry can make people feel excluded.5

Brands are paying attention to this, and they are tackling harmful, dated representations of beauty through their products, in media, and in society. Some of the ways they are doing this include:

- Diverse product ranges and shade/tone inclusivity: This area considers a wide range of consumer attributes but includes offering products for different life stages, hair and skin types, and colour cosmetics that compliment different skin tones.

- Gender-neutral products: Some personal care brands are creating gender-neutral product lines to break away from traditional gender stereotypes. This encourages consumers to break out of boxes and to express themselves in the way that they wish.

- Accessibility: Making products accessible to all individuals, including those with disabilities. This includes brands who are designing packaging and products with features like easy-open lids and clear labelling for those with visual impairments.

- Advertising and representation: Using diverse models and spokespersons in advertising, marketing campaigns and websites. Brands aim to represent and celebrate a wide range of body types, ages, ethnicities, and identities.

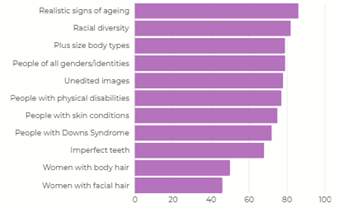

Consumers feel this same sentiment with many hoping to see more diversity and representation in beauty/grooming advertisements. You can see the specific detail in the graph below, but this includes seeing realistic signs of ageing as well as racial diversity, skin conditions and imperfect teeth.

“Would you like to see each of the following in beauty/grooming advertisements?” 6

- Language: Being mindful of the language used in marketing and labelling to avoid reinforcing stereotypes and exclusion. An example of this is the removal of the word ‘normal’ from beauty packaging, as research by Unilever found that 7 in 10 people agreed that using the word “normal” on products and in advertising has a negative impact.5

Expressive and experimental – Beauty your way

The topics we’ve discussed so far are empowering consumers and encouraging them to be more expressive and experimental. Personal care products and solutions across hair, skin and body care can help them to embrace their individuality and express themselves confidently, in the way that they choose. Sixty-two percent of Gen Z agree that their beauty routine is primarily about how they want to see themselves.1

Makeup as a form of self-expression

Makeup enables individuals to experiment with colours, texture and techniques to create striking and expressive looks. No single look dominates as consumers seek options and the chance to vary their makeup choices based on event, mood and/or feeling that day. We are therefore seeing a range of trending looks across social media channels including grunge-inspired looks featuring dark smoky colours and “strawberry makeup” which combines shades of pink, glossy lips and faux freckles.

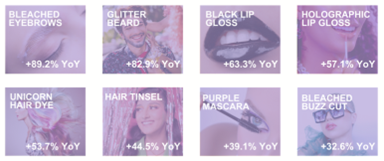

Google searches of self-expressive makeup.7

The image above shows the increase in Google searches across different expressive beauty products, highlighting the desire to stand out through beauty as self-expression.

Brands can help consumers to feel more comfortable trialling new looks through product bundles with complimentary products and innovation in applicators that make recreating these trends more achievable. For example, make-up stickers, curved applicator handles and eyeliner stamps.

Whichever look they choose, there’s a focus on expression, creativity and fun. Forty-six percent of Gen Z and 36% of millennials wear make-up because it brings them joy.8 Brands should therefore consider how to use mood-boosting ingredients/formulations, fragrance and sensory in their products. Retail spaces may also appeal as they enable consumers to see, touch and smell products. A formulation that falls under this topic would be our tomato & red clay eyeshadow - give it a try!

‘Skinimalism’ and embracing natural skin as a form of self-expression

Embracing natural skin in beauty has been a growing trend in the industry over the past several years. Freckles, pores and blemishes, to name a few characteristics that were once considered ‘flaws’, are now embraced, with the aim that consumers feel empowered and free. This reflects the greater focus on health within the personal care category and a shift in the perception of beauty among consumers, as mentioned earlier.

Trending looks in this area, such as the “clean girl” look, typically feature light, neutral colours and minimal product usage. They focus on achieving a glowing, healthy complexion rather than the heavy makeup and airbrushed looks that were popular in the past. In fact, glowing, radiant and luminous skin finishes made up a big proportion (43%) of skin finishes discussed on social media.9

In product selection, there is therefore a strong emphasis on boosting skin barrier health and strengthening its function. SPF claims are another priority as consumers recognise the importance of it for maintaining healthy and youthful skin. Brands can offer hybrid products that allow a combination of these priorities such as lightweight BB creams with SPF, complexion serums and skin tints. Why not try our 3-in-1 acne prone hero tinted mineral sunscreen SPF 31 - test it for yourself!

Skin care and makeup removal

Skin barrier health and SPF considerations carry over into skin cleansing, a crucial step following the wearing of colour cosmetics and sunscreen. Gently removing excess dirt, makeup, sunscreen and impurities encountered throughout the day helps to support healthy skin, a priority for consumers.

Brands should consider the consumer demand for science-backed solutions, skin sensitivity concerns and a continued shift to barrier repairing and strengthening narratives in their product development.

With sunscreen use on the rise, cleansers designed to effectively remove sunscreen are also increasingly sought after due to concerns around blocked pores, breakouts and potential side-effects of SPF ingredients. Why not try our bi-phasic makeup remover and see the difference for yourself.

Hair colour as a form of self-expression

Hair colour continues to be a driving force for self-expression, as consumers become more adventurous about trying out new tones and look to add joy. Hair colour is considered one of the boldest beauty statements a person can make and 28% of women colour their hair to express themselves.10 WGSN predict that in the near future we will see beauty consumers of all ages and genders feeling brave.

One-third of Gen X female survey respondents (UK) claimed they would consider a unique hair colour, with purple, pink and blue ranking the highest.10 Striking shades like these allow individuals to personalise their look, serving as a signature style that sets them apart. Additionally, vibrant hair colours can evoke positive reactions from others, making individuals feel appreciated and admired.

Formats and formulations focus on affordability and easy application as more consumers experiment with at-home hair colour. Market examples include hair colour sprays that rinse out and drops that can be added to conditioners at customisable intensity to add a semi-permanent hue in an array of different shades. Alternatively, see the results for yourself with our vivid metamorphosis semi-permanent hair colour cream.

Brand can support consumers during experimentation with online tutorials and how-to guides accessed through QR codes, and helplines to help correct any mishaps.

Hair care and maintenance

More frequent colouring of the hair can lead to increased hair damage, resulting in both structural and aesthetic issues such as hair breakage or a straw-like feel. Consumers who are experimenting with hair colour will therefore be looking for products that target these signs of damage and care for the hair, such as rebuilding and deep conditioning treatments. Trial out our hair bonding and scalp revitalising conditioner and see the difference for yourself.

Summary

The self-expression trend in beauty and personal care is reflective of many of today’s consumers and their need for authenticity, inclusivity and experiences. As their perception of beauty has changed over the last few years particularly, they are increasingly committed to being true to themselves and embracing who they are. The trend provides the opportunity to celebrate individuality and encourage creativity across beauty applications. Consumers expect brands and product offerings to align with their values and provide solutions for their personal attributes and needs, whilst encouraging them to experiment across personal care categories.

References

1. Cassandra, 2022, ‘The Fresh Face of Self-Expression’ - https://big-village.com/news/the-new-meaning-of-beauty/

2. Dove, 2023, https://realcostofbeauty.dove.com/

3. Cult Beauty, 2023, https://www.cultbeauty.co.uk/cant-retouch-this.list

4. Euromonitor, 2022, ‘Voice of the Consumer: Beauty’.

5. Unilever, 2021, ‘Unilever says no to ‘normal’ with new positive beauty vision’, https://www.unilever.com/news/press-and-media/press-releases/2021/unilever-says-no-to-normal-with-new-positive-beauty-vision

6. Mintel, 2023, ‘Diversity and Inclusivity in Beauty - US – 2023’.

7. SPATE, 2023, US Search - from Jun 2022 to May 2023 vs. Jun 2021 to May 2022.

8. NPD Group, 2022, ‘Makeup Attitudes and Usage Report’.

9. WGSN, 2022, ‘WGSN TrendCurve: Evolving Skin Finishes’.

10. OnePoll, 2022, ‘Color Confidence’.